Michigan Lawmakers Approve Marijuana Tax Increase Projected To Raise $420 Million In Annual Revenue

Michigan marijuana tax increase just roared through the Senate on a razor-thin vote, a 24 percent wholesale levy pushed across the finish line at an hour when the Capitol’s fluorescent lights feel like interrogation bulbs. Nineteen yeas, seventeen nays. That’s how the sausage got made. The haul is a projected $420 million in new revenue, earmarked for roads—the cracked arteries of a state built on wheels and steel. The alternative, lawmakers reminded everyone all day and into the night, was a budget deal collapsing in a heap and a shutdown nobody wanted to own. In the end, the Legislature chose asphalt over absolutes, grit over purity, betting that the Michigan cannabis market can absorb another tax without buckling at the knees.

Politics is the art of what’s possible, Senate leadership said—leaning into the cliché because it was earned. The governor huddled with swing votes. The House Speaker paced, warning that a misstep could send the budget into the ditch. A Democratic senator floated a 20 percent compromise with a tie-bar to nicotine and e-cigarette taxes, then watched the room do the math and shrug. There were backroom whispers, caucus arm-twisting, and the quiet calculus of, “Will this kill jobs or just irritate donors?” Dissent wasn’t cleanly partisan either. You had Republicans saying crank the tax even higher to right-size a market they think overpromised the state’s coffers, and Democrats—some of them—wondering what happens to small dispensaries when wholesale costs climb. When the gavel finally dropped, it felt less like a triumph than a necessary, gritty bargain, the kind you justify to yourself while staring at the ceiling at 4 a.m.

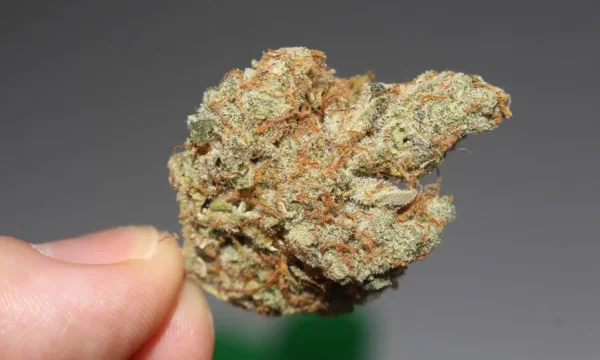

The price of a joint, the cost of a road

Here’s the unromantic mechanics of cannabis taxation: a wholesale excise tax rarely sits quietly in the supply chain. It rolls downhill. Producers squeeze margins or raise prices. Distributors pass it along. Retailers recalibrate menus, then customers decide whether to keep playing in the legal sandbox or drift toward a buddy with a backpack and no receipts. Some lawmakers argued the legal cannabis revenue hasn’t matched the hype; others warned a steep levy might shrink the industry and shutter storefronts from Kalamazoo to the Keweenaw. They’re both right in their own way. What Michigan does next will matter—how it enforces, how it spends, how it protects smaller operators from getting steamrolled by consolidation. Other states are tinkering with structure too: New England lawmakers just greenlit a shift to a more conventional market model, a reminder that business dynamics can be as consequential as tax rates—see New Hampshire Lawmakers Approve Bill To Let Medical Marijuana Dispensaries Convert To For-Profit Businesses. And while Michigan fine-tunes its revenue machine, labor standards and worker protections remain part of the pressure cooker, as seen in the Pacific Northwest’s legal fight over voter-approved workplace rules—read: Oregon Officials Ask Federal Court To Reverse Ruling That Blocked Marijuana Industry Labor Law Approved By Voters.

Beyond the balance sheet: fields, labs, and the long game

If you want to know where cannabis is heading, don’t just watch the cash registers; watch the fields and the labs. In farm country, a new crop can change the rhythm of a town. Just across state lines, the first medical marijuana harvest is already in the barn, with leaders predicting more acreage and a sturdier agricultural backbone in the months ahead—see Kentucky Cultivator Harvests State’s First Medical Marijuana Crop As Governor Predicts Farmers Will ‘Grow A Whole Lot More’. At the other end of the spectrum, scientists are still peeling back layers of this plant like an onion in a hot pan, turning up novel compounds with potential to reshape how patients, consumers, and regulators think about cannabis. Breakthroughs in antioxidant and anti-inflammatory properties hint at therapeutics beyond the buzz—see Scientists Discover New Cannabis Compound With ‘Remarkable Antioxidant And Skin Anti-Inflammatory’ Benefits. Tax policy that chokes innovation or drives operators out of the legal market is a short-sighted feast. Smart taxation doesn’t just count beans; it fertilizes the field so next year’s harvest is bigger and cleaner.

So what does the 24 percent wholesale tax do on the street, not the spreadsheet? Expect an adjustment period. Wholesale quotes inch up. Retail menus shuffle toward value packs and house brands. Some consumers shrug and keep swiping; others split their loyalty between dispensaries and the unregulated market. Watch these tells: the gap between legal and illicit prices, the rate of new business openings versus closures, and the tax revenue curve six, twelve, eighteen months out. If the Michigan cannabis market holds, lawmakers will say they called it. If revenue pops and then plateaus as shops thin out, we’ll be back here again, arguing about elasticity over bitter coffee. There’s room for nuance in the next phase—targeted relief for small operators, clearer reinvestment into communities, and a transparent ledger that shows every dollar going from joint to jackhammer. Until then, we live with the bargain we made in the tired hours, and we see if the road it paves can carry the weight. If you’re looking to explore premium options while the dust settles, take a quiet detour through our shop: https://thcaorder.com/shop/.