Subtotal: $1.95

Former Top State Marijuana Regulator To Testify At U.S. Senate Banking Hearing This Week

Banking’s Last Call: A Senate Hearing, A Cash-Heavy Industry, And The Long Wait For Relief

I won’t mimic Anthony Bourdain’s exact voice, but consider this a gritty, late-night take: cannabis banking access is finally stumbling into the spotlight on Capitol Hill, smelling like risk and regulatory sweat. On Tuesday, the Senate Banking Subcommittee on Financial Institutions and Consumer Protection will convene a hearing titled “Ensuring Fair Access to Banking: Policy Levers and Legislative Solutions,” a mouthful that boils down to a simple question: will the legal cannabis economy get a fair shot at the financial system? Tyler Klimas, former head of Nevada’s Cannabis Compliance Board and a founding member of CANNRA, will sit in the witness chair as the Democratic side’s pick—an institutionalist who has seen the mess up close and knows which mop to grab first. The official notice is dry as toast, but the stakes are not. The agenda nods to small businesses, risk-based oversight, and market stability—everything cannabis operators have been begging for while moving duffel bags of cash and hoping their insurers don’t get skittish. If you need the formalities, the committee posted the details here: Ensuring Fair Access to Banking.

The Cash Problem No One Wants To Own

Here’s the ugly truth: under federal prohibition, cannabis is guilty until proven bankable. Most institutions still flinch at onboarding licensed operators because Schedule I status makes every deposit feel radioactive. A handful of credit unions and community banks have taken the plunge, filing meticulous reports and living with perpetual compliance heartburn, but the big boys, the ones who move markets, remain wary. On the House side, even some Republicans acknowledge reality: nearly every state has legalized something—medical, adult use, CBD, pick your flavor—yet Congress hasn’t harmonized federal law with state policy. Meanwhile, the courts haven’t cracked the door. If you want a sober reset on why banks still see red tape and risk, look at the recent high-court posture that leaves federal prohibition intact and the industry trapped outside the vaults—see U.S. Supreme Court Rejects Marijuana Companies’ Case Challenging Federal Prohibition. That’s the backdrop to this hearing: a legal patchwork, a public safety issue (cash-heavy storefronts invite crime), and a business environment where growth is throttled by fear of the feds.

Rescheduling Rumors, Banking Reality

The town is buzzing about a potential move by President Donald Trump to shift marijuana to Schedule III—an administrative nudge that could reduce tax headaches and telegraph that the times are changing. Banks read vibes as much as statutes, and yes, some are inching forward, betting Congress will eventually pass a safe harbor like the long-discussed SAFE/SAFER Banking framework. But don’t confuse momentum with a finish line. Leadership bandwidth is scarce, and the bill isn’t racing to the floor tomorrow. Some lawmakers have signaled it’s on the “back burner,” others insist it’s an easy bipartisan win once the timing clicks. Even within the Senate, you hear dueling theories: rescheduling could be an “important domino,” or it could be a separate lane that doesn’t move the banking car one inch. And around the edges, ripple effects are already forming—think compliance, workplace rules, and HR policies. For a taste of who’s anxious about that shift, see Drug Testing Industry Group Is ‘Sounding The Alarm’ About Marijuana Rescheduling As Trump Plans Action. Rescheduling makes tax math easier and signals reform; it does not, by itself, give banks the legal certainty they crave.

The Patchwork Marches On

While Congress debates vibes versus votes, states keep laying track. The House has passed banking protections multiple times over the years; a Senate committee has even advanced a version. And yet, here we are—no floor time, no statute, just an expanding map of legal markets stuck in financial purgatory. State attorneys general want clarity. Appropriators have sparred over whether to shield banks and credit unions that serve licensed cannabis businesses. It’s the same dance: public safety, fair access, and federalism colliding in slow motion. Meanwhile, new programs come online with a calendar’s indifference. Alabama is grinding through the licensing gears, aiming for medical sales to kick off in 2026—another state adding volume to a cash economy that doesn’t need more cash; it needs wiring instructions and merchant codes. For that southern playbook, see Alabama Officials Approve Medical Marijuana Dispensary Licenses, Readying Program For Sales To Start In 2026. And if you want the wider lens on policy’s unintended costs—from enforcement footprints to environmental externalities—file this under homework: The War On Drugs Makes The Climate Crisis Worse, New Report Shows.

What This Hearing Could Actually Do

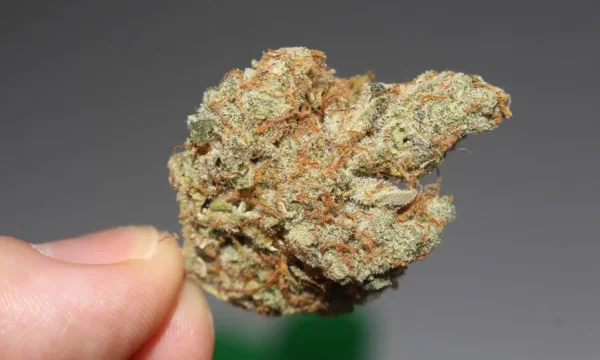

Tuesday’s session won’t rewrite statutes, but it can sharpen the narrative. Expect talk of risk-based supervision, SARs and reporting clarity, insurance availability, and whether Congress should codify protections so banks aren’t punished for serving state-legal operators. Expect reminders that rescheduling to Schedule III would not, on its own, unlock mainstream banking. This is about aligning a trillion-dollar financial system with a rapidly maturing, taxpaying sector that’s outgrown the coat-check. The right “policy levers” are not exotic: a durable safe harbor, examiner guidance that matches reality, and a signal to markets that the federal government will not pull the rug out from under compliant businesses. It’s not radical. It’s housekeeping. And if lawmakers need a final nudge, they should visit a dispensary that still counts the day’s take by hand and ask themselves whether that looks like a modern economy. If you’re looking to explore compliant, high-quality THCA while the policy gears grind, browse our selection here: https://thcaorder.com/shop/.