Proposed Texas Hemp License Fee Hike Will Force Businesses To Close, Advocates Say

The 13,000 Percent Question

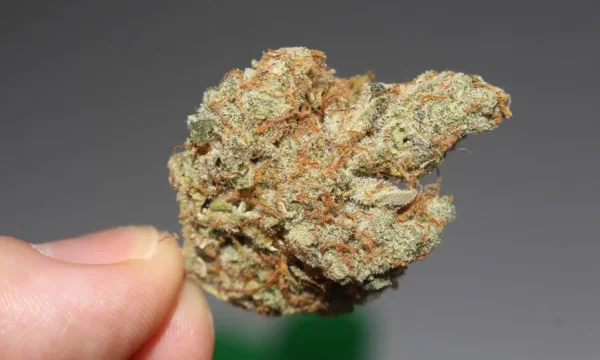

Texas hemp license fee increase. Say it out loud like a bar tab gone sideways at last call. What state health officials are floating isn’t a nudge. It’s a sledgehammer: manufacturer licenses jumping from $250 to $25,000 per facility, retail registrations vaulting from $150 to $20,000 per location—annual, not once-and-done. A 13,000 percent thunderclap aimed squarely at the Texas cannabis market, wrapped in the language of “oversight” and “public health.” The proposal also sets 21 as the minimum purchasing age, demands age verification, and includes mandatory product recalls. On paper, that’s sober, responsible cannabis regulation. In practice, small-town shops and mom-and-pop manufacturers stare down a bill they can’t pay, a lock on the door they never wanted, and a lesson in how policy dressed as safety can look a lot like taxation without mercy.

The Fine Print That Cuts Deep

Here’s the pivot point: new testing rules and “total THC” limits that would sideline the hemp flower—the very backbone for edibles and smokables—because the plant naturally runs hotter than the proposed cap. If flower gets iced, the market tilts toward synthetics and conversions that can skirt the plants’ stubborn biology. That’s a funny way to promote public health. Meanwhile, agencies divvy up jurisdiction like brisket, with the Texas Department of State Health Services (DSHS) handling thousands of non-alcohol retailers and the Texas Alcoholic Beverage Commission (TABC) minding its own 60,000 licensees. The scaffolding is complicated. The impact is simple: pay up or get out. You can read the proposal in the state’s own ledger—the kind of document that smells like toner and inevitability—over at the Secretary of State’s posting and recent hearing notices, where shop owners and veterans lined up to testify about what keeps them sleeping through the night and what doesn’t. For the data-minded, the state’s table setting looks like this:

- Retail registration: from $150 to $20,000 per location, per year.

- Manufacturer license: from $250 to $25,000 per facility, per year.

- Minimum age: 21, with verification requirements.

- Mandatory recalls and stricter labeling/testing protocols, including total THC limits.

“Many small businesses simply cannot absorb this level of cost and will be forced to shut down rather than renew.”

That isn’t hyperbole. It’s the math of thin margins, especially when DSHS tallies up projections as if every retailer will just swallow twenty grand and smile. They won’t. Some will fold. Others will drift into the unregulated shadows that these rules claim to chase out of town.

Public Health, Or A Cover Charge No One Can Afford?

Supporters say the licensing spikes are overdue—kids must be protected, labels must be honest, and compliance isn’t cheap. They want more enforcement and harsher penalties for unlicensed actors. A few voices even push to lift the minimum age higher, tack on public-education and treatment surcharges, and widen the concept of “societal costs” until it swallows the whole ledger. That argument has an emotional beat. It also blurs into policy as morality play, where the fee becomes a quasi-sin tax without calling it one. But while Texas contemplates steering the market into a smaller corral, other states are building lanes for growth. Look east and you’ll find proof that sensible rules and real access can feed legal cannabis revenue instead of starving it; Massachusetts didn’t stumble into the win column by accident, and its next act—social spaces, more tourism dollars, a sturdier ecosystem—wasn’t conjured in a lab. For a snapshot of that bigger picture, see Massachusetts Hits $10 Billion Marijuana Sales Milestone, With Top Official Saying Consumption Lounges Will Bolster Industry In 2026. Closer to home, Texans who served overseas told regulators the quiet part out loud: plant-derived products help them sleep, tame their anxiety, and keep nightmares where they belong. Sidelining those options in the name of a cleaner marketplace doesn’t erase demand; it reroutes it—fast.

The Politics Of Control

Texas didn’t land here by accident. Lawmakers debated a full ban on consumable hemp last year, then went home empty-handed. The governor vetoed the ban but came back with an executive order, pushing agencies to tighten the screws without dragging the Legislature back for another rodeo. That move set the stage for today’s fee shock and THC testing rules that feel, to many shop owners, like a ban by another name. One retailer called the $20,000 price tag “death by 20,000 cuts.” It’s not isolated, either. The federal backdrop still yawns with contradictions—alcohol culture coasts while cannabis stays fenced off under federal criminalization, even as Washington’s posture keeps shifting in small, telling ways. For example, read how the political center of gravity wobbles on one foot and then the other: GOP Congressman Dismisses Concerns About Marijuana Rescheduling Delay, Saying Trump Made It ‘Very Clear’ DOJ Must Act and the parallel theater in booze-world guardrails in Trump Administration Ditches Alcohol Limit Guidance As Marijuana Remains Federally Criminalized. Policy is a piecemeal puzzle. Businesses are expected to guess the missing pieces—and pay for them.

Here’s the throughline: access versus control, and who gets crushed in the middle. If Texas loads cannabis taxation by another name onto licensing and testing, it could kneecap the legal market before it ever finds balance. Consumers don’t vanish; they migrate. Veterans don’t stop needing relief because a form costs more. And small storefronts don’t suddenly become multi-state operators when the invoice hits five figures per location. States that treat the industry like a partner seem to reap steadier outcomes; states that treat it like a perp get headlines, then gray markets. Even medical programs can stall when politics outpaces pragmatism—see the cautionary tempo in Kentucky Governor ‘Not Satisfied’ With Medical Marijuana Access Rollout, But Expects Pace To ‘Pick Up Significantly’ In 2026. Texas can course-correct here. Calibrate fees to actual regulatory costs. Set clear THC testing that reflects plant reality, not fantasy. Enforce the rules that matter—and stop pretending a paywall equals safety. Until then, the market will keep doing what it always does: finding gaps, bleeding talent, and teaching us, again, that prohibition by spreadsheet is still prohibition. When you’re ready to explore compliant THCA options from a source that takes quality as seriously as you do, step into our shop: https://thcaorder.com/shop/.