Michigan House Speaker Threatens To Shut Down Government If Marijuana Taxes Aren’t Increased

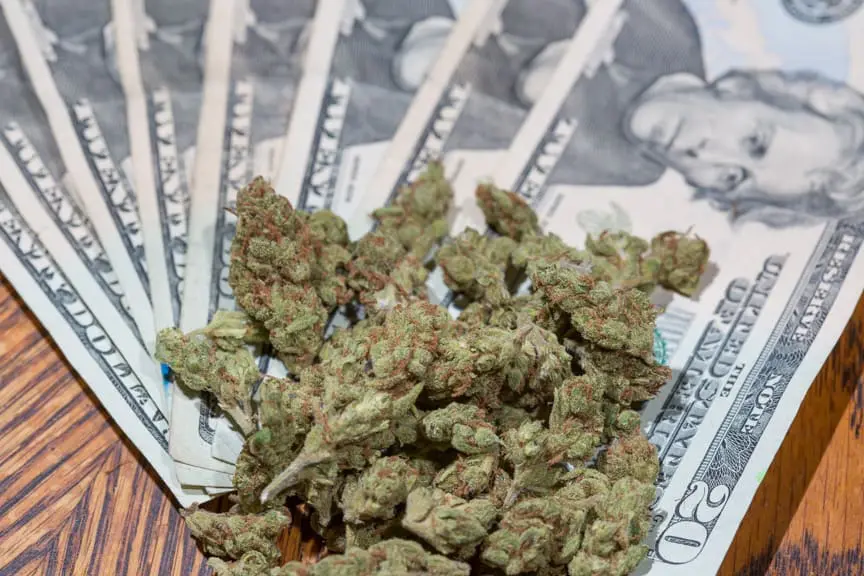

Michigan marijuana tax increase. That’s the headline and the hangover. A 24 percent wholesale levy on cannabis is being shoved to the center of the table, chips all-in, as lawmakers horse-trade over roads and power. House Speaker Matt Hall says the deal’s done—Senate Majority Leader Winnie Brinks offered marijuana as the revenue engine, Governor Gretchen Whitmer nodded, and now the Senate must “perform” or the budget collapses. No stopgap. No keep-the-lights-on extension. Just a hard cliff and a shutdown threat, the kind of brinkmanship that smells of cold coffee and hot microphones. This is cannabis taxation as bare-knuckle politics, with the Michigan cannabis market staring down a price hike that could tilt the board. The question isn’t whether lawmakers can ink a number—it’s whether that number keeps people in the legal cannabis revenue stream or punts them back to the gray corners they crawled out of when voters chose reform.

Deals, defiance, and the market’s pulse

The vehicle is House Bill 4951, pushed in the lower chamber by Rep. Samantha Steckloff of Farmington Hills, a plan that would layer a fresh wholesale tax onto a young industry still finding its legs. On paper, it’s another line item; in reality, it’s the difference between Michigan remaining a magnet for bargain hunters and becoming just another state with heavy-handed policy. Industry operators rolled into Lansing to warn lawmakers: Jack up the levy and you risk shrinking payrolls, thinning margins, and bleeding demand to cheaper outlets. Ann Arbor’s Sen. Jeff Irwin has been blunt about the stakes—prices are the draw, and price is a jealous god.

“If our prices are no longer attractive to customers in Michigan or from other states, we’re going to lose a lot of those customers.”

He also argues legislators should respect how voters set up cannabis tax distribution in 2018—and if anyone wants to rework that machinery, Michigan’s constitution demands a three-quarters majority. In other words: don’t move the goalposts without a supermajority and a really good reason.

A 20 percent olive branch—tied to tobacco and vapes

Then, in the kind of late-night wrinkle that defines state capitols in budget season, a Senate amendment surfaced to clip the rate to 20 percent and connect the change to a broader nicotine-tax revamp. Detroit Sen. Stephanie Chang floated the tweak as a “concept,” a conversation starter that would tie-bar HB 4951 to her separate plan to tax several tobacco products and e-cigarettes at a wholesale rate of 57 percent. She’s done this dance before; an earlier iteration stacked an additional 75 mills on cigarettes and brought noncigarette tobacco into the same high-percentage tent. Chang’s amendment might give cover to wavering senators who want to say they shaved something off the top, but she admitted she hadn’t lined up House support and wasn’t betting the farm on passage. The irony? Hall claims he already dragged a floated 32 percent cannabis rate down to 24 in the name of sanity. There’s a sense that every fraction point carries consequences—political, fiscal, and cultural. For source material and bill text, see HB 4951’s analysis and language via Michigan’s Legislature and the nicotine-tax proposal at House Bill 4951 and Senate Bill 582, while the broader political stakes were chronicled by Michigan Advance’s reporting (read here).

Price, power, and the illicit shadow

Strip away the marble and microphones, and you’re left with street math. Raise a wholesale tax and something gives: margins, retail prices, or both. In a market where out-of-state customers cruise in for deals and locals have grown used to legal shelves with friendly numbers, price shocks punch above their weight. If legal prices inch toward the illicit, some buyers will drift back to untested baggies and cash-only corners. That’s not just lost legal sales; that’s lost compliance, lost safety, and lost tax receipts. Hall himself has wondered aloud whether a hike would change consumption habits—the cardinal sin in revenue forecasting. Budget writers prefer reliable spigots; cannabis is still a roller coaster. And wholesale taxes don’t always fall neatly on producers. They seep into consumer prices, especially when operators already juggle compliance costs, lab testing, and capital scarcity. This is where policy reform meets human behavior: a few bucks on a gram can tip the scales between checkout and walkout. Lawmakers like Irwin argue the smart move is to lock in legal advantages, not smother them just as Michigan finds its stride.

Brinkmanship with a fuse

So we circle back to the threat. Hall says the Senate made the promise, the House took the risk, and if the upper chamber can’t land the votes as agreed, there’s no more duct tape to stretch the budget. If the Senate trims the terms to 20 percent or splices in tobacco taxes, he warns the House will strip the changes and bounce the bill back—ping-pong on a countdown clock. Meanwhile, businesses hold their breath, workers eye the schedule, and consumers watch the horizon. What to watch next: the final rate, whether a tie-bar sticks, and whether anyone recalibrates the 2018 revenue model without the supermajority Irwin says the constitution requires. In a state that paved its cannabis path with a promise to voters and a nod to market reality, the next few days will reveal whether the Capitol values steady legal growth or short-term budget sugar. When the dust settles and the ink dries, keep your palate sharp and your options open—and if you prefer to shop legal and clean without the drama, you can find what you need here: https://thcaorder.com/shop/.